It’s officially spooky season and healthcare cost increases for 2026 are sure to scare. While you’re considering what costume to wear this year (my daughter Amelia is going to be a ladybug!), you may also be pondering what to do about the expected premium increases coming our way in 2026.

Healthcare expenses are expected to jump to the highest they have ever been, impacting people across the board.

A few of the largest factors affecting rising prices include new tariffs on pharmaceutical drugs, new weight loss treatments, and more effective cancer treatments (Aspan, Luhby). Many people are also making better use of mental health services, which increases costs for insurers (Luhby).

TenBridge Partners recently hosted a table for the State of Regional Healthcare presentation organized by the Portland Metro Chamber where we heard from the leaders of Kaiser NW, Providence, and the Portland Clinic. All echoed the same rising costs associated with delivery of care and how they are adapting and changing their business models in response.

Additionally, some hospitals, doctors’ offices, insurance companies and other health care businesses have merged or consolidated which has lessened competition (Aspan).

Healthcare prices have been increasing for years and putting continued pressure on American households. Although inflation has cooled off in the last couple years, prices are beginning to rise again also due in part to tariffs. For example, last year, the average U.S. employer spent more than $19,000 per employee to provide family coverage while the employee kicked in $6,000 (Aspan). The total average family premium of $25,572 has increased 52% in the past decade (Aspan).

TenBridge Partners provides healthcare for our employees, and likewise the cost to cover a family in 2025 – 2026 is $31,453 per year per family. Incredible premiums and huge expenses.

Next year, employers are predicted to be hit by an increase of 9% or more and are expected to pass on most of the burden to employees (Aspan). Since employers typically consider health care benefits as part of total compensation to employees, many employers will likely spend less on salary or hourly pay increases if they choose to shoulder the burden of healthcare increases (Aspan).

For enrollees in the Affordable Care Act (ACA) plans on the healthcare marketplace, not only do they face general cost increases, but the end of enhanced federal subsidies is also looming.

These subsidies called premium tax credits (PTCs) help lower the cost of insurance coverage for people who purchase insurance through the ACA marketplace and will expire at the end of the year. Between the H.R.1 Act signed into law this summer and disagreements leading to the government shutdown this fall, Congress has not agreed to extend the subsidies.

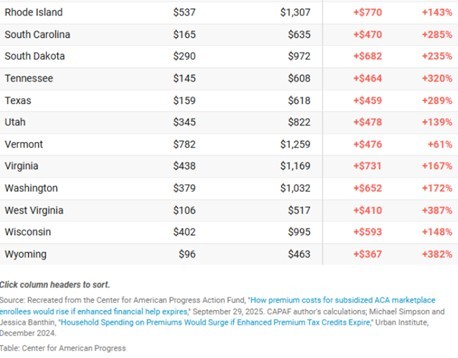

If the PTCs expire, the Center for American Progress shows the projected national increase in the average premium for marketplace enrollees will be roughly 136% nationwide (Gee). Though the increases are above 300% for some states. In Oregon and Washington, the expected increase is about 57% and 148% respectively. See the chart included below from the Center for American Progress for estimated cost increases in your state.

For folks on Medicare, Part B premiums are expected to rise 11-12% with a projected increase of $21.50 per month. This would bring the current base premium from $185 a month to $206.50. This would represent the largest year-over-year jump in the program’s history.

Whether you receive healthcare through your employer, the marketplace, or Medicare, be prepared for increases next year.

How is TenBridge proactively responding?

We are currently working through our clients’ financial plans given their specific circumstances to assess the impact of these increases on their overall financial health and will be proactively reaching out to those most affected. If you have any questions about how this may impact your overall plan, give us a call – our door is always open.

We will help you find the clarity to move forward with confidence, and it is always a pleasure to be of service.

In the meantime, we wish you a lovely autumn and happy Halloween.

Citations

Aspan, M. (2025, September 12). Health care costs are soaring. blame insurers, drug companies – and your employer. NPR. https://www.npr.org/2025/09/12/nx-s1-5534416/health-care-costs-soaring-blame-your-employer

Gee, E. (2025, September 29). Health insurance premium costs will more than double for millions of Americans unless Congress Acts – Center for American Progress. Center for American Progress. https://www.americanprogress.org/article/health-insurance-premium-costs-will-more-than-double-for-millions-of-americans-unless-congress-acts/

Luhby, T. (2025, September 4). Why your health insurance copays, deductibles and premiums will probably surge next year | CNN business. CNN. https://www.cnn.com/2025/09/04/business/health-insurance-premiums-cost-increase

About TenBridge Partners

TenBridge Partners is an independent financial planning and investment management firm based in Portland, Oregon with a simple focus of honoring the fiduciary responsibility of putting clients first.

Planning is central to everything we do. Our focus is on a complete understanding of a client’s and potential client’s needs through the financial planning process, before we move forward with anything else.

We bring clarity and confidence to an otherwise confusing financial world.

We are about people.

Sirra Anderson Crum CFP®

Financial Planner