When the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, and its successor, SECURE 2.0 Act of 2022, went into effect they came with many changes. Some you may have come to know, like how it increased the age to 73 for required minimum distributions from retirement accounts. Though many changes are not well known. Some have followed a tiered approach, so adjustments weren’t implemented immediately or aren’t scheduled to begin until a future date. In addition, some rules weren’t clear, so the IRS had to issue additional guidance on how to interpret the rule.

Therefore, we felt it prudent to share the main concepts you should be aware of including changes to:

Required Minimum Distributions

529 Plans

Employer and Employee Roth Issues

Catch-up Contributions

New Employer Sponsored Retirement Plans

Employees to Build Retirement Savings

Employer Plan Eligibility

10% Early Withdrawal Penalty Exceptions

Read on to learn what these changes mean for you.

Required Minimum Distributions –

The Secure Act increased the age for required minimum distributions (RMD) to the year in which you turn age 73. In 2033, the RMD age will increase to age 75.

The Act also impacted Inherited IRA rules. Before the change, most beneficiaries could “stretch” their distributions over their lifetime. Now, how long you have to distribute funds from the IRA depends on what type of beneficiary you are. If you are a spouse, Secure 2.0 didn’t change your ability to transfer the inherited assets into your own IRA and treat the funds as your own, subject to your own RMD age. For most “non-spouse” beneficiaries, such as children, siblings, etc., you must withdraw the assets within 10 years. Starting in 2025, the IRS clarified that non-spouse beneficiaries must take a distribution from the Inherited IRA each year or they will be subject to the excise penalty tax.

Hence why we are actively working with clients to maximize retirement account withdrawals during their lifetime which can maximize investment brokerage accounts savings for our clients and their heirs. Our newsletter Savings Taxes in Retirement – Over the Long Run discusses this topic further.

529 Plans –

Beginning in 2024, beneficiaries of 529 plans can make transfers up to $35,000 from the 529 into a Roth IRA without incurring income tax or the 10% early withdrawal penalty. Though, the 529 plan must be at least 15 years old, and the majority of assets cannot come from funds contributed within the last 5 years. These rollovers are also limited to the annual contribution limits, but the adjusted gross income limit is waived.

What This Means for You

The new rule creates flexibility for how leftover 529 funds may be used. The ability to rollover 529 funds into a Roth IRA for the benefit of your kids, grandkids, or other loved ones still provides them with a wonderful advantage, just for retirement instead of education.

In addition, the 15-year clock is on the 529 account, not the beneficiary. Meaning you may also change the beneficiary to yourself and rollover the funds into your own Roth IRA.

Employer and Employee Roth Issues –

As of 2022, employers who have 401(k), 403(b), and governmental 457(b) plans can now make Roth (post-tax) contributions on the employees’ behalf, if the plan document allows it. The employer still gets the deduction for the contribution, though the employee will need to declare the contribution as current income. Although this new feature may sound exciting, the IRS needs to provide guidance due to potential vesting schedules. For example, if an employee leaves the firm before they become 100% vested, the contribution would be forfeited but the employee already paid taxes on the compensation. In addition, many retirement plan platforms do not have capabilities to code an employer contribution as “Roth”, so there may be delays or workarounds in implementing this rule.

SEP-IRAs also allow for a Roth employer contribution. The employee will be taxed on the employer contribution as income, but since SEP’s have 100% immediate vesting, this avoids worry over being taxed on money the employee might not receive.

Since 2023, SIMPLE IRA and SIMPLE 401(k) plans may accept Roth employee deferrals.

What This Means for You

For some people, treating more of your retirement contribution as Roth can be advantageous, for others it may not matter or be disadvantageous. Our newsletter, Roth IRAs Demystified, discusses the tradeoff in further detail.

For employers, this may result in increased administration costs and time required to ensure contributions are treated properly. Though most plans we help set up have immediate 100% vesting for employees anyway.

Catch-up Contributions –

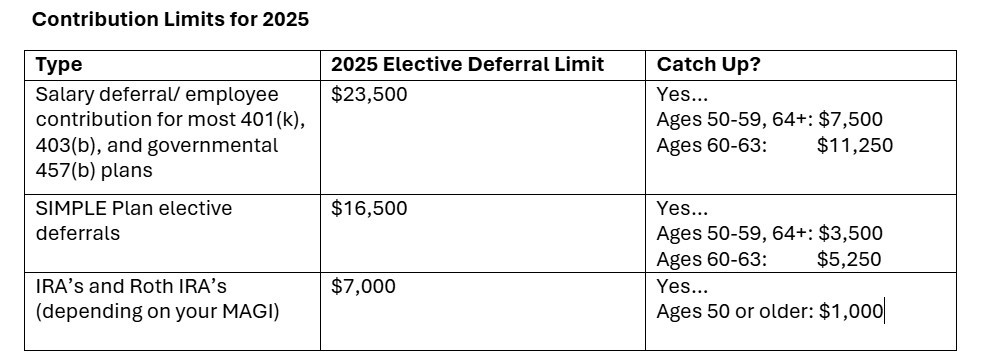

Catch-up contributions have a few key changes. Typically, anyone over age 50 can contribute an additional $7,500 into their 401(k), 403(b), and governmental plans. Additionally, the age 50+ catch up is $3,500 for SIMPLE IRA and SIMPLE 401(k) plans.

Beginning in 2025, if you’re ages 60-63, you’re eligible to defer an additional amount into your employer plan which takes place of the usual catch-up contribution. For 401(k) or 403(b) plans, the catch up is $11,250. For SIMPLE IRA’s or SIMPLE 401(k)’s, the catch up is $5,250. For more information on 2025 maximum deferral amounts, refer to the bottom of this article.

For anyone in a 401(k), 403(b), or 457(b) plan who makes over $145,000 in 2025, their catch-up contributions in 2026 must be made on a Roth (after-tax) basis.

Lastly, the IRA catch-up provision for those age 50+ is $1,000 and will begin indexing for inflation in $100 increments.

What This Means for You

Catch-up contributions can be a useful tool for those who maximize their retirement contributions.

For employers, the new rule for employees who make over $145,000 in 2025 may result in increased administrative costs and time. To keep things clean, employers would want to set up two accounts for the participant. One for traditional contributions and another for Roth contributions.

New Employer Sponsored Retirement Plans –

Small businesses with 1-50 employees receive an increased tax credit for qualified start-up costs when starting a new plan. It’s now 100% per year for the first three plan years, though there’s a maximum of $5,000 per year.

Small businesses also may qualify for a new credit of up to $1,000 per employee per year for employer matching during the first five plan years. The credit is 100% for the first and second plan years, then 75% for year three; 50% for year four, and 25% for year five. Unfortunately, this credit is not available for workers making more than $100,000 and the limit is indexed each year. The credit also doesn’t apply to contributions to a defined benefit plan.

New individual 401(k) plans can receive deferrals until the due date of the employee’s tax return for the first year of the plan. This is different than the general rule where deferrals must be made before the income is earned.

What This Means for You

If you have a small business and would like to start an employer-sponsored plan, it may be an ideal time to do so due to these available tax credits.

The new individual 401(k) plan rule provides new “last minute” individual 401(k) plans a couple advantages over using a “last minute” SEP-IRA.

Employees to Build Retirement Savings –

Beginning 2025 for any new employer plans, there must be an “auto enroll provision”. The only employers who are exempt are ones who are less than 3 years old, or if there are less than 10 employees. Exempt plans include SIMPLE plans, governmental plans, and church plans. The auto enrollment provision must start at 3% or more and auto escalate 1% per year up to 10% for employee deferrals.

What This Means for You

The auto enroll feature will hopefully encourage people to contribute more to retirement.

For employers, this provision could result in added administrative costs and time. A way to avoid the administrative burden of auto-escalation is to set enrollment at 10% for new employees, then employees can elect their own deferral percentage.

Employer Plan Eligibility –

Starting this year, if an employee has worked 500-999 hours for the last two consecutive years, they’re eligible to defer to an employer plan. This rule applies to most part-time employees. In addition, if the employee achieves eligibility for the employer match according to the employer plan parameters, matching is required.

What This Means for You

It’s important to note that those with individual 401(k) plans or SEP-IRA’s who have part-time employees may need to allow your employees into the plan. This may result in additional administrative costs, time, and impact how much you can defer into the plan.

10% Early Withdrawal Penalty Exceptions –

Disaster distributions up to $22,000 for any federally declared disaster after January 26, 2021, are exempt from the 10% early withdrawal penalty (EWP). This removes the requirement for Congress to declare which federal disasters are allowed to receive this treatment. Disaster withdrawals can be income taxed and/or paid back over three years.

In addition, there’s now an exception to the EWP for people who are terminally ill. Being terminally ill is usually defined as 24 months, however Secure 2.0 expanded it to 84 months. These distributions can be repaid within 3 years.

In 2024 there’s a new exception for distributions of $1,000 for “unforeseeable or immediate financial needs relating to necessary personal or family emergency expenses.” Withdrawals can be repaid within 3 years.

Starting in 2024 domestic abuse survivors may withdraw the lesser of $10,000 or 50% of their vested retirement account without incurring the EWP. The withdrawal must be within a one-year period after the person was abused and the person is allowed to self-certify they’re a victim of abuse. Unfortunately, the provision isn’t allowed for plans that are subject to the qualified pre-retirement survivor annuity (QPSA) and qualified joint and survivor annuity (QJSA) rules because the worker’s spouse, who is often the abuser, would have to sign off on the withdrawal from these plans. The withdrawals can be repaid within 3 years.

Our Door is Always Open

There have been many changes due to the SECURE Act and SECURE 2.0. We are simply highlighting some important changes that impact our clients the most. If you have questions on how these changes may impact your unique situation, please know our door is always open and we are happy to help you find answers and solutions.

As always, it is a pleasure to be of service.

About TenBridge Partners

TenBridge Partners is an independent financial planning and investment management firm based in Portland, Oregon with a simple focus of honoring the fiduciary responsibility of putting clients first.

Planning is central to everything we do. Our focus is on a complete understanding of a client’s and potential client’s needs through the financial planning process, before we move forward with anything else.

We bring clarity and confidence to an otherwise confusing financial world.

We are about people.

Sirra Anderson Crum CFP®

Financial Planner

The information contained in this correspondence is intended for general educational purposes only and as a means for facilitating a conversation. Please consider our door always open to discuss your particular situation and how this information might benefit you and fit your specific needs.