There are always events in the economy and the market which cause investors to pause. We look forward to the future, sometimes with hope, or with fear, and sometimes in anticipation. 2024 is no different and there are many factors at play, some of which could impact our investments and some of which most likely won’t.

This month, we wanted to look at news clips and topics on our collective minds, with an eye on what it means for our investments and how they might or might not impact our strategy and long-term goals.

Election Cycle

Speculation always abounds during an election cycle. Who gets elected and what they promise are often thought by the public to be important when it comes to their investments. What we find is quite the opposite, and more often than not, matters very little.

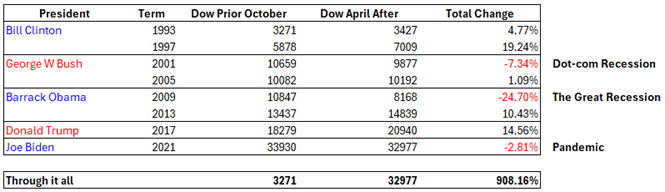

When it comes to the market, we looked at the last eight elections and measured where the Dow Jones Industrial Average was on October 1st before the election results were known and then again on April 30th after they took office. In five cases, whether they were republican or democrat, the market was up over those seven months. In the three cases where it was down, there was a very good economic reason for the negative return.

Over the course of the last 30 years there has been five (5) presidents; three democrats and two republicans. Each ran on a different platform, and each made promises in their campaign that weren’t lived up to.

Bill Clinton promised universal healthcare.

George W Bush promised the creation of personal investment accounts in Social Security.

Barack Obama promised to close Guantanamo Bay.

Donald Trump promised to build a wall and make Mexico pay for it.

Joe Biden promised to block all new fracking on federal lands.

So, no matter what they say or what we think they are going to do, sometimes we forget the president does not run the country. Rather, it is a very large collective of people who run the country, many of which the president has very little sway over. There are 100 senators, 453 representatives, 25 cabinet members, and thousands more career federal workers.

To sum it up, Michael Schmidt in his article “Talk is Cheap: Campaign Promises and the Economy”, said it well (Talk is Cheap) I’ll let him put the exclamation point on the point!

The Bottom Line

It’s interesting to see how history tends to repeat itself and how short-term our memories can be. With good intentions, presidential candidates stage their platforms with campaign promises designed to sway voters’ opinions and get elected. Some of the promises are ideological in nature and difficult to quantify, while others are more direct and accountable. In an ideal world, each campaign promise would be presented with the complete story, but the political process doesn’t seem to promote that concept.

Campaign promises can create controversy, evoke emotions, and can tilt an election toward the candidate that either has the best promise or markets the ideas the best. It would be ideal for all presidential candidates to just tell us that we will have to raise taxes and cut spending to make ends meet, but unfortunately, what candidates promise and what they are able to deliver can be very different things, particularly when candidates are met with unforeseen political or economic hurdles once in office.

Our Election Cycle Conclusion – investment impact potential is minimal at best.

Cooling Economy

Overly hot economic growth is rarely good for financial markets or consumers, bringing about massive amounts of price inflation.

Presently, the economy is cooling off, but not to the point of a recession. The economy appears to be moving in the right direction.

A survey of economic conditions across the country found expectations for the future of the economy were for slower growth over the next six months due to uncertainty around the upcoming election, domestic policy, geopolitical conflict and inflation.

Job openings are rising. The labor market is strong, but not overheated. The economy is still creating new jobs as the job market normalizes and comes back into balance.

Consumers are spending less and borrowing more, bringing about a slowdown. The slowdown is not troubling for the economy as it helps relieve inflationary pressure.

A slowing labor market and economy are exactly what the Fed has been looking for. This combination bolsters the Federal Reserve’s confidence for interest rate cuts this year. These lower rates would make borrowing less expensive and can be a tailwind for both stocks and consumers.

In the meantime, record high household wealth, rising disposable income and relatively low unemployment could keep the economy growing at a moderate pace in the months ahead.

Because our economy has been so strong for so long, stocks keep climbing to new highs as stock markets have been rising around the world and setting records. Over the last nine months, America’s S&P 500 has experienced its best streak in more than three decades.

Investors may worry that a reversal and downturn surely is coming. But remember that among the bear markets and crashes, American stocks have delivered an annualized real return of 6.5% since 1900. This is a time to set aside concerns and invest for the long run.

Here is the open question: will the economy’s slowing be a soft landing or a recession? Can the economy slow, and inflation continue to subside without a recession occurring?

Our Cooling Economy Conclusion – A soft landing is likely because of a rosy decent job growth picture, slowly falling inflation and the potential for declining interest rates. Though it is possible the slowdown could go too far and bring the economy into a recession, we think this will likely not happen.

Covid-19 and Future Public Health Emergencies

There has been an uptick in cases this summer, which has caused some concern. This winter, Covid-19 peaked in early January, declined rapidly in February and March, and by May 2024 was lower than at any point since March 2020 (Covid-19). While the summer surge has become an annual pattern, the coronavirus is still unpredictable. We need more data to predict the “seasonality” of covid flares and if there truly is a pattern. Although Covid-19 is not the threat it once was, it is still associated with thousands of hospitalizations and hundreds of deaths each week in the US and can lead to Long Covid, which needs more research in and of itself (Covid-19).

On an economic basis, the recession we experienced in Spring 2020 was one of the steepest declines in our post-World War II era, but it also had the quickest recovery due to expansive fiscal stimulus and economic relief packages. Real gross domestic product (GDP) fell 9% at the start of the pandemic, but by the first quarter of 2021, real (inflation-adjusted) GDP surpassed its pre-recession peak (Chart). Inflation also created a challenging environment for monetary policy, requiring efforts to bring down inflation while maintaining high employment, though the economy ended 2023 with high employment and falling inflation (Chart). By the end of 2023, job creation was well above initial projections and economic activity was slightly above pre-pandemic projections (Chart).

There has been conversation about what we learned, what measures are being put in place to avoid another pandemic, and how we would support our society if it happened again. Interestingly, in 2021 the Global Health Security Index ranked the US number 1 in pandemic preparedness out of 195 countries (Nuzzo). Though, the US had the most fatalities from Covid out of all “prepared countries”, and third most in the world. Out of the many reasons we had such high fatalities, one particularly interesting reason is we didn’t make full use of the preparedness capacities at our disposal. In other words, we didn’t use all the tools in our tool belt, or they weren’t used effectively.

Looking forward, the White House established a new Global Health Security Strategy which will strive to make the country better prepared for future pandemics, outbreaks and biological threats regardless of where they occur (Emanuel). The new strategy will expand health security partnerships and efforts around the world, in addition to working on better coordination within the US government. The World Health Organization is also working on its own agreement to help the world be better prepared for the next public health emergency. Although we are seeing these steps forward, experts see gaps within the strategy and worry that finances will limit the impact (Emanuel).

Moving past the science and bureaucracy, experience is one of the most valuable components of learning and preparedness. What we choose to do with our experience is what matters. As a people, we know what to expect and how to endure the unique struggles a pandemic presents.

Today, many people work in hybrid environments or work completely remotely – a rare phenomenon in the pre-pandemic world. We have learned how to use video conferencing, grocery delivery, telehealth, and more. Most importantly, we all learned how to properly wash our hands!

Although science, public health departments, the healthcare system, and the government are critical parts of protecting us from another similar event – it is important to remember that we have our experiences to help us navigate through the rough waters.

Our Future Public Health Emergencies Conclusion – Though unpredictable and hard to plan for, we believe we have learned from the events of Covid-19, and future health emergencies will be better met with an appropriate response.

Market Concentration

We are in an environment where a handful of stocks have been responsible for most of the market’s growth and decline. You may have heard talk of the “Magnificent 7”. These are the 7 tech stocks that have been contributing the most to the market since early 2023 (Apple, Amazon, Microsoft, Tesla, Meta, Nvidia and Alphabet). These stocks are leading the way in the growth of Artificial Intelligence and are some of the most profitable companies in the world.

This isn’t the first time there has been an overconcentrated market, and it’s also not the most concentrated market we’ve had. Between 2005 and 2007 there was a large increase in home prices, lending practices were out of control and banks were increasing leverage using collateralized debt obligations. Energy stocks were the golden investments, led by Marathon Oil (+224%), Valero Energy (+209%) and Occidental Petroleum (+164%). The ten largest holdings in the S&P 500 during this period accounted for nearly 80% of the S&P 500 performance.

Most of us know what happened after 2007. We fell into what is known as the Great Recession in 2008-2009. The S&P 500 dropped over 20% during this period. The cause of this was due to many bankruptcies among investment, retail and commercial banks. They used too much leverage and followed poor loan underwriting standards.

In 1998, we started the Dot-com bubble. The ten largest holdings in that period accounted for nearly 60% of the S&P 500 performance. Some of these stocks had astronomical gains, led by Qualcomm (+2,690%), Amazon (+1,416%), Apple (+683%) and Cisco Systems (+477%).

Then 2000 came and many young, unprofitable tech startup businesses that were “the next big thing” went bankrupt as they weren’t actually making any money. The S&P 500 dropped nearly 38% between 2000-2002. The same companies leading the charge in the two years before led the decline. Qualcomm (-79%), Cisco Systems (-76%), Amazon (-75%) and Apple (-72%).

We are not seeing the same underlying issues that previous overconcentrated corrections were seeing. Our banking system is in a much healthier position than it was in 2007. The companies leading the charge during this Artificial Intelligence rally are some of the most profitable companies in the world, not early-stage tech companies with little or no history of profitability.

Our Market Concentration Conclusion – Market overconcentration is not as rare as it seems. Corrections are a normal part of the stock market and will continue to occur, but maintaining a diversified portfolio will make the journey much smoother.

All things considered

2024 is an interesting year with the upcoming election, a cooling economy, awareness of public health and market concentration. The outcome of the election will have minimal impact on our investments. We are likely looking at a soft landing for our economy. Our country has learned a lot from the pandemic. Lastly, we will keep in mind market concentration has happened before and as such, stay diversified. It is helpful to look at these factors and keep them all in perspective, especially with the help of historical precedence and our own experience and preparedness.

Our focus continues to be on the long-run, goal orientated, and client centric. We do this by using the financial plan as our guide. When we keep our focus on the horizon and our ultimate aims, it leads to much better results. There is a lot of noise right now, and honestly some of it could negatively impact our portfolio returns. But there is nothing to be afraid of nor are they a harbinger of doom. Across every single decade, there has always been a plausible reason to react. But in our decades of experience, it is often better to tune out the noise and fear, keeping our eye on the ball.

It is always a pleasure to be of service, let us know how we can help.

Citations

At last, Wall Street has something to cheer. (2024, July 18). Economist.

“Chart Book: Tracking the Recovery from the Pandemic Recession.” Center on Budget and Policy Priorities, Center on Budget and Policy Priorities, 3 Apr. 2024, www.cbpp.org/research/economy/tracking-the-recovery-from-the-pandemic-recession#:~:text=In%20July%202020%2C%20CBO%20published,pre%2Dpandemic%20January%202020%20projections.

“Covid-19 Can Surge throughout the Year.” Centers for Disease Control and Prevention, Centers for Disease Control and Prevention, 3 July 2024, www.cdc.gov/ncird/whats-new/covid-19-can-surge-throughout-the-year.html.

Emanuel, Gabrielle. “The U.S. Has Come up with Its Own Global Strategy to Thwart the next Pandemic.” NPR, NPR, 16 Apr. 2024, www.npr.org/sections/goatsandsoda/2024/04/16/1245142431/the-u-s-has-come-up-with-its-own-global-strategy-to-thwart-the-next-pandemic.

Hansen, S. (2024, July 19). The economy is cooling, and that’s good news. Morningstar, Inc. https://www.morningstar.com/economy/economy-is-cooling-thats-good-news

“Implications of Index Concentration on Equity Market Return Patterns.” Jensen Investment Management, March 2024.

https://www.jenseninvestment.com/insights/index-concentration/

Matadors gather. (2024, July 17). Economist.

Nuzzo, Jennifer B., and Jorge R. Ledesma. “Why did the best prepared country in the world fare so poorly during COVID?” Journal of Economic Perspectives, vol. 37, no. 4, 1 Nov. 2023, pp. 3–22, https://doi.org/10.1257/jep.37.4.3.

Smart, T. (2024, July 18). Economy slowing but not in recession territory as pivotal election nears the 100-day mark | economy | U.S. news. U.S. News. https://www.usnews.com/news/economy/articles/2024-07-18/economy-slowing-but-not-in-recession-territory-as-pivotal-election-nears-the-100-day-mark

“Talk is Cheap: Campaign Promises and the Economy.” Investopedia, Economy, Government & Policy, September 14th, 2023.

www.investopedia.com/articles/economics/09/campaign-promises-president.asp

From the desk of

Erik Lawrence CFP®

www.tenbridgepartners.com

971-277-1077

The information contained in this correspondence is intended for general educational purposes only and as a means for facilitating a conversation. Please consider our door always open to discuss your particular situation and how this information might benefit you and fit your specific needs.